The latest tweaks to the Community Reinvestment Act (CRA) are more than just troubling—they’re a full-on alarm for anyone who’s been tracking how these financial institutions play the game. Listen up, because it’s about time we peeled back the layers on these glossy “improvements” that seem to leave our communities hanging more often than not.

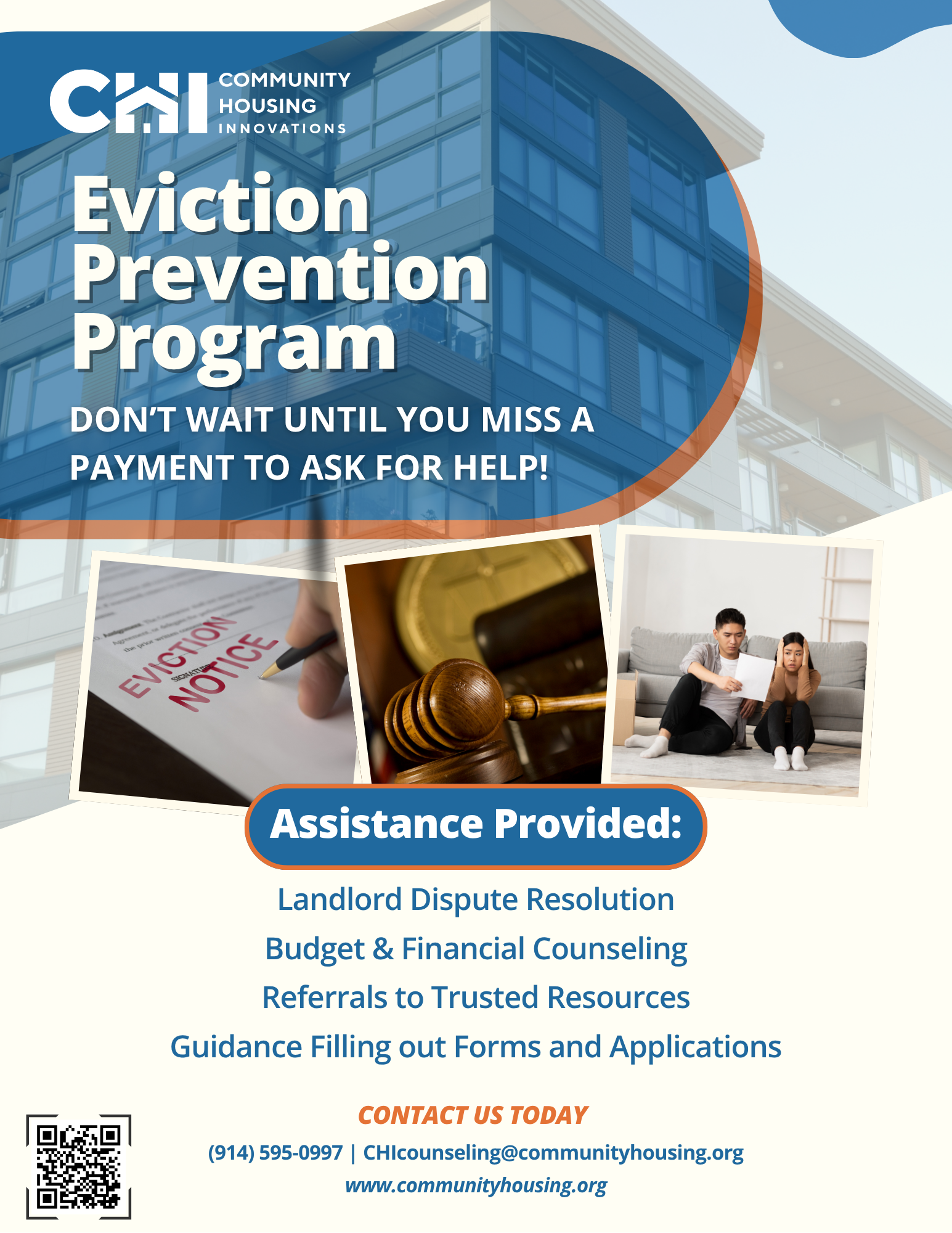

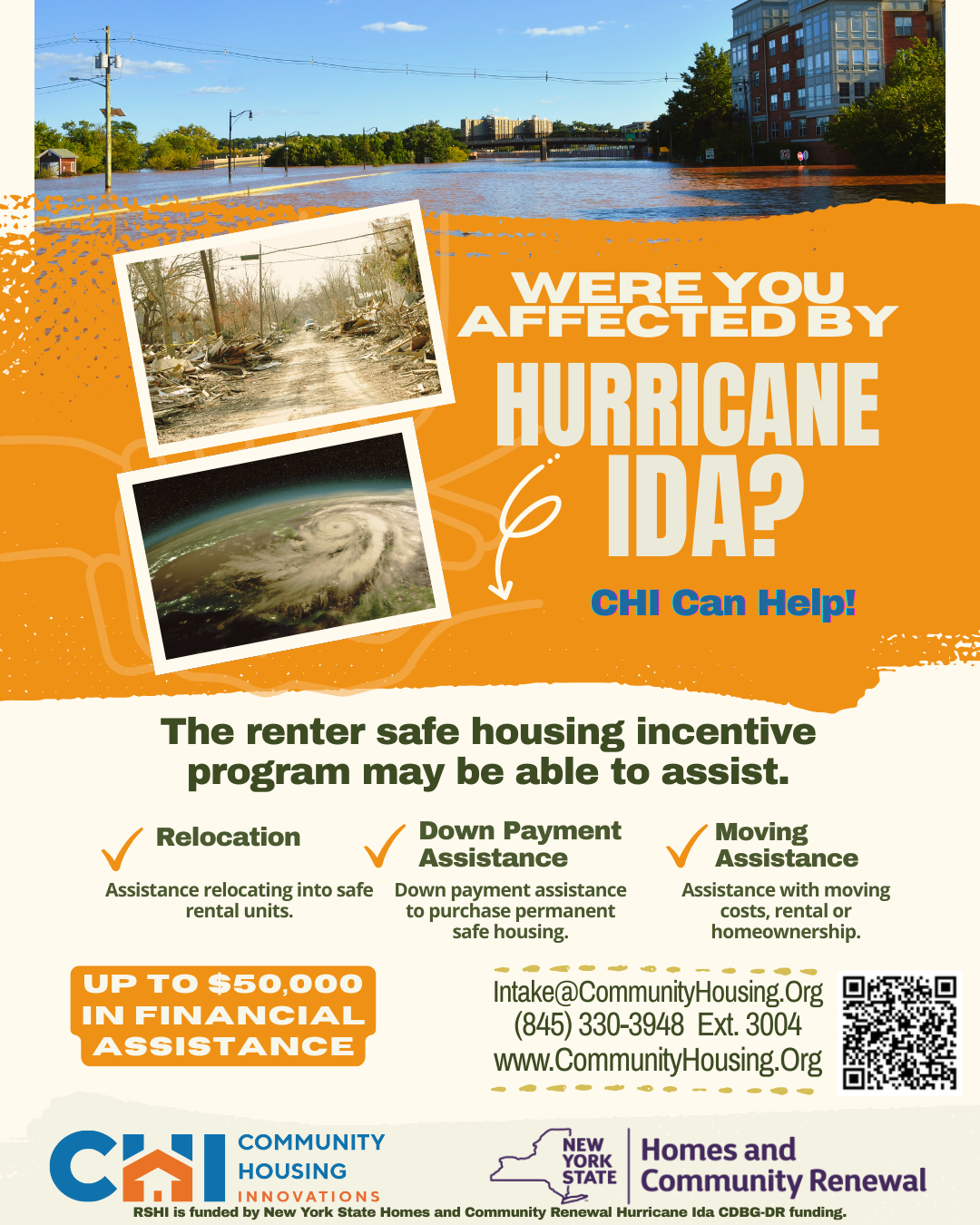

Here’s the real tea: these banks, these big-money outfits that pledge to pump life into our neighborhoods with community development, are falling short. Way short. Reports are showing that they’re only hitting 30%-40% of their promised funding budgets. Now, you have to ask yourself—why the gap? Is it that hard to see where the money is truly needed, or is it just more convenient to turn a blind eye?

And get this—while they’re under-delivering, they’re still patting themselves on the back for checking off compliance boxes with these new CRA rules that barely scratch the surface of real community upliftment. We’re talking about SBA 504 loans that now automatically qualify as “economic development,” letting banks rack up CRA credits for doing the bare minimum. Meanwhile, the actual impact? The real people and projects that need that money? They’re left clutching at straws.

Now, Texas has been bold enough to step up and challenge this charade, questioning whether these new rules are just smoke and mirrors. They’ve thrown down a legal challenge that’s got everyone talking—because if the promised impacts aren’t being met, and a significant chunk of the budget isn’t even being spent, then what are we really doing here?

And here’s a question that’s burning hotter than a Texas summer: in the financial climate that New York State is in, doesn’t our state budget need some relief? Our own backyard is being neglected while these financial institutions continue to make empty promises.How many times are we going to let them pledge their so-called “community obligations” without holding them to account?

Financial institutions are failing at their obligation to educate the community about accessing these funds. They’ve got all this info tucked away in their community strategic plans, but when you ask about CRA or community development funding, it’s like you’re speaking a foreign language.It’s like waiting for a dad-beat dad who promised to pick you up, and you’re dressed and watching the window and door, but he never shows up. Disappointed in the level of intent they make this information accessible, especially as an entrepreneur.

It’s time to cut through the BS and get straight to the source of this funding for our communities.We need to demand transparency and accountability. It’s not just about meeting quotas or filling pots with money that never reaches those who need it most. It’s about making sure every dollar promised for community development is a dollar spent on actual, impactful projects. It’s about making sure our voices aren’t just heard, but acted upon. New York, Texas, every state affected—this is our call to stand up, get loud, and make sure these financial institutions that patronize our community aren’t just taking us for a ride.

So, let’s keep pushing, let’s keep demanding better, and let’s ensure that these CRA credits aren’t just another way for banks to look good on paper while our communities struggle. It’s time to flip the script and make these rules work for us, not against us.

Excellent!!!!

Thank you 🫶 Sharing my lens🧐

Great article, especially for those of us who like our information in bites sizes (translation: words and terms we laymen can understand).

The most bold and beautifully brilliant woman I have the honor of hearing speak.